Content

- The 3 Licensing Trends We’re Watching in 2021

- Are you a Good Licensor? Tips to Maximize your Partnership with Licensees

- Royalty Accounting 101: Do You Really Know How Royalties Impact Your Business?

- Music Royalty Accounting Software Built for the Needs of the Music Business

- The Basics of Royalty Accounting: What You Need to Know

- Products

The staff is proactive and responds to our needs in a timely manner. You can also select any companies that should also receive a share of royalties, for example if you have a label assistant that is paid on a percentage basis, or if you are a distributor and are assigning a share for yourself. Company shares can be assigned on a net or gross basis (gross meaning that other entities are assigned a percentage of the amount remaining after that company has taken its cut). For each row, select the correct artist, remixer or company, select an account for them if you wish to separate payment (more on this elsewhere), and enter in either the percentage or the amount you wish to pay them.

Copyright law gives the owner the right to prevent others from copying, creating derivative works, or using their works. Copyrights, like patent rights, can be divided in many different ways, by the right implicated, by specific geographic or market territories, or by more specific criteria. Each may be the subject of a separate license and royalty arrangements. Patent rights may be divided and licensed out in various ways, on an exclusive or non-exclusive basis. A license may encompass an entire technology or it may involve a mere component or improvement on a technology. In the United States, «reasonable» royalties may be imposed, both after-the-fact and prospectively, by a court as a remedy for patent infringement.

The 3 Licensing Trends We’re Watching in 2021

Neither he nor his family received any royalties, although the Copyright Act of 1790 was then in place. Until the mid-18th century, American popular music largely consisted of songs from the British Isles, whose lyric and score were sometimes available in engraved prints. Mass production of music was not possible until movable type was introduced. Music with this type was first printed in the US in 1750.[27] At the beginning the type consisted of the notehead, stem and staff which were combined into a single font. Later the fonts were made up of the notehead, stems and flags attached to the staff line. Royalty accounting can be somewhat complex, especially depending on the contract terms that are negotiated.

While a payment to employ a trade mark licence is a royalty, it is accompanied by a «guided usage manual», the use of which may be audited from time to time. However, this becomes a supervisory task when the mark is used in a franchise agreement for the sale of goods or services carrying the reputation of the mark. For a franchise, it is said, a fee is paid, even though it comprises a royalty element. Typically, an investor may receive a regular monthly or quarterly payment based on a company’s sales.

Are you a Good Licensor? Tips to Maximize your Partnership with Licensees

In this case, lessee will become lessor for sub lessee and lessee for main landlord. Mistakes in royalty reporting can burden your company with audits and penalties. Avoid distracting from your company’s mission with administrative work.

The minimum payment threshold is set on the first page of the contract tab. Although widely used, the prime difficulty with this method is obtaining access to data on comparable technologies and the terms of the agreements that incorporate them. ] organizations (see «Royalty Rate Websites» listed at the end of this article) who have comprehensive[citation needed] information on both royalty rates and the principal terms of the agreements of which they are a part.

Royalty Accounting 101: Do You Really Know How Royalties Impact Your Business?

It is to be remembered that the Minimum Rent may or may not vary in different years. The Minimum Rent or actual royalty, whichever is higher, is to be paid to the lessor. For example, X leased a mine from Y at a Minimum Rent of Rs. 12,000 p.a. In discussing the licensing of Intellectual Property, the terms valuation and evaluation need to be understood in their rigorous terms.

- It is common in the UK for example, for authors to receive a 10% royalty on book sales.

- The royalty that is paid to the composer and publisher is determined by the method of assessment used by the PRO to gauge the use of the music, there being no external metrics as in mechanical royalties or the reporting system used in the UK.

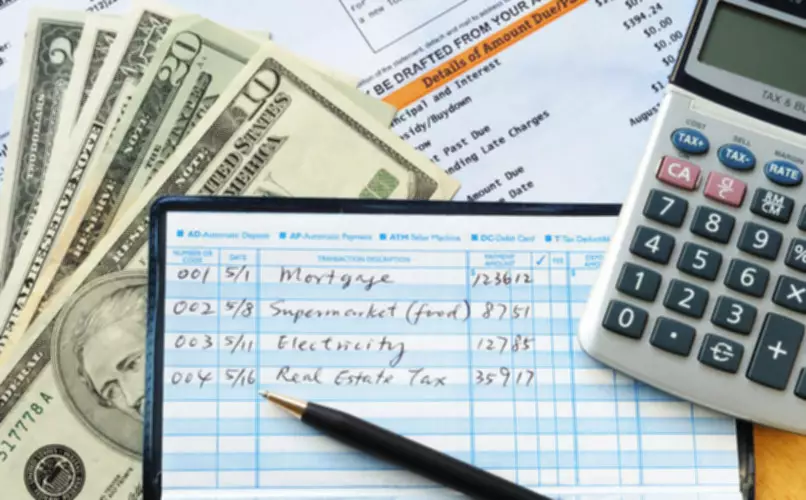

- Every financial action in your business is added to your ledger and results in simultaneous changes to at least two accounts, but it’s not always clear whether these are increasing or decreasing an account’s value.

- According to Joel Mabus, the term synchronization «comes from the early days of the talkies when music was first synchronized with film».[60] The terminology originated in US industry but has now spread worldwide.

- ASCAP, BMI, and SESAC exempt church worship services from performance royalties, but make no exemption for church-hosted concerts.

- From the standpoint of conservatism a provision should be made for such short-workings against Profit and Loss Account in that particular year when such short-working appears.

- For example, if royalty amount is 1,000,000/-& rate of TDS is 10%, then lessee will pay Rs. 900,000/- to lessor.

- A similar situation arises when there is the option of working the technology in one of two different regions; the risk elements in each region would be different.

Until this advance is earned out, the unearned balance will appear as a negative balance forward when accouting for royalty payments. When a company (recording label) records the composed music, say, on a CD master, it obtains a distinctly separate copyright to the sound recording, with all the exclusivities that flow to such copyright. The main obligation of the recording label to the songwriter and her publisher is to pay the contracted royalties on the license received.

In the United States, in contrast, SoundExchange, ASCAP, BMI (Broadcast Music, Inc) and SESAC (Society of European Stage Authors & Composers) are the four principal Performance Rights Organizations (PROs), although smaller societies exist. The royalty that is paid to the composer and publisher is determined by the method of assessment used by the PRO to gauge the use of the music, there being no external metrics as in mechanical royalties or the reporting system used in the UK. They «directly» pay the songwriter and the publisher their respective shares.

- Still, there was a balance of Rs. 4,900 (Rs. 10,000 – Rs. 1,100 – Rs. 4,000) for 1998.

- Unpaid Royalties cause a balance to be carried forward as well when accounting for royalty payments.

- Dramatically improve processing speed with a system built to handle huge data volumes.

- Third parties pay authors, musical artists, and production professionals for the use of their produced, copyrighted material.

- But, as per question, maximum amount of recoupment should be Rs. 3,500.

Royalty Solutions is a reliable and professional partner that we highly recommend to any music creator or publisher who wants to get paid fairly and efficiently for their work. Accounting for

royalty arrangements may be challenging due to different royalty rates, possible

reserves for returns, cash advances, “free” goods options and other individually

agreed upon terms with owners of intellectual rights. Therefore, it is

preferable to use services of specialists, such as royalty accountants to reduce

the risk of misstatements in financial statements. We have a rigid workflow defined to help keep things on track when it comes to requesting invoices before you make payments, LabelGrid record labels and distributors accounting software can handle every part of the royalty payments process for you.

For example, if the carrying amount of a royalty asset exceeds its

recoverable amount by $100, then impairment is posted in the books of the intellectual

rights owner (licensor). Let us assume the

subsequent royalty payment is 6% of net income of $10,000 paid quarterly. At

the end of the quarter, royalties due https://www.bookstime.com/articles/royalties-accounting are calculated by multiplying net income

of $10,000 by 6%, which is $600 (Period 1). After the prepayment is exhausted,

the licensee’s cash balance is credited (Period 2). Under the circumstances, during the period of Strike or Lock-out, there will neither be short-working nor will there be any recoupment.

- Once you are happy with everything (be sure to double check it one last time), click ‘Save and next’.

- Where Royalties are less than minimum rent and shortworkings are recoverable in next years.

- In the event of Strike, the Minimum Rent was to be reduced proportionately, having regard to the length of the stoppage.

- Whether the common law conception of an individual economic right as an «individual right of control of usage» is compatible with the Code Civil origins of droit de suite is open to question.

- Thus, total amount of short-working which is carried forward is Rs. 18,000 (i.e., Rs. 11,000 for first year and Rs. 7,000 for 2nd year).

- Revenue is measured at the fair value of the consideration received or receivable and recognised when prescribed conditions are met, which depend on the nature of the revenue.

An example of royalties would be payments received by musicians when their original songs are played on the radio or television, used in movies, performed at concerts, bars, and restaurants, or consumed via streaming services. In most cases, royalties are revenue generators specifically designed to compensate the owners of songs or property when they license out their assets for another party’s use. If you are a record label or a distributor and are looking for an accounting software to handle royalty payments for your artists and clients, LabelGrid offers a system to streamline these operations. LabelGrid generates quarterly or monthly artist statements or label statements with an automated invoicing management system to save time and keep things organized. Unearned advances should remain on the asset side of the balance sheet until they are earned out, at which point the book is transferred to the liability side. Advances that have not earned out should be written off after it reasonably appears that they are not ever going to earn out.

Excluding all non-royalty expenses, the transaction in our example has grossed £90,000 in profit. In turn, it has increased the company’s value by that same £90,000. We can also now easily see what our reserve balance is, and the level of pre-paid royalties—which is negative here because we did not include the creation of the initial advance. Imagine that your newly released, internationally acclaimed title A Guide to Simple Royalty Management has just earned its first sales. Your distributor has informed you that it has sold 10,000 copies in its first day, generating £100,000 of revenue. The basic advantage of this approach, which is perhaps the most widely applied, is that the royalty rate can be negotiated without comparative data on how other agreements have been transacted.